Disclaimer: This post is not legal advice. The information here only applies to suing a debt collection agency for FDCPA violations. For any other type of lawsuit, please consult a licensed attorney. All dollar amounts are rounded to the nearest $100.

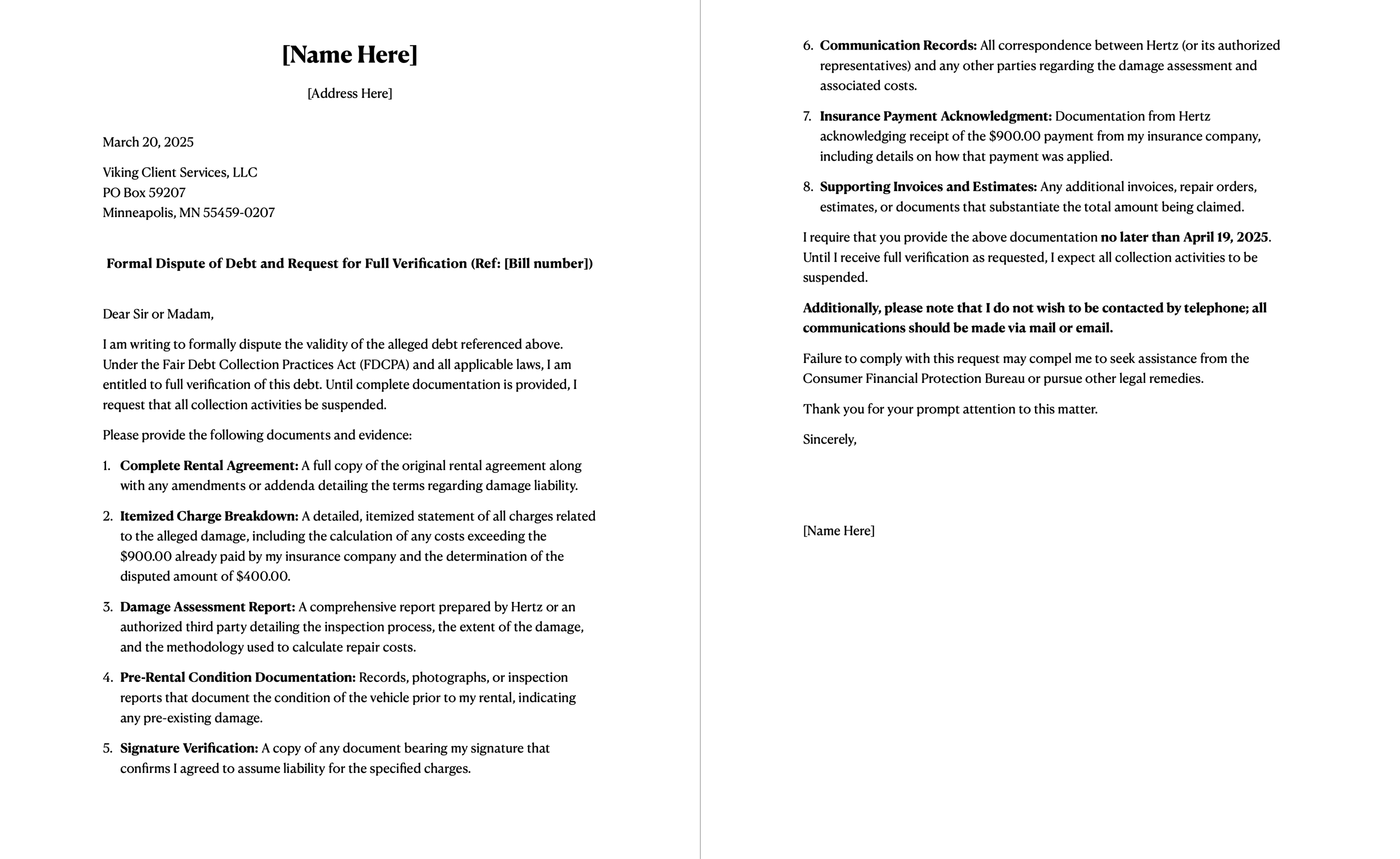

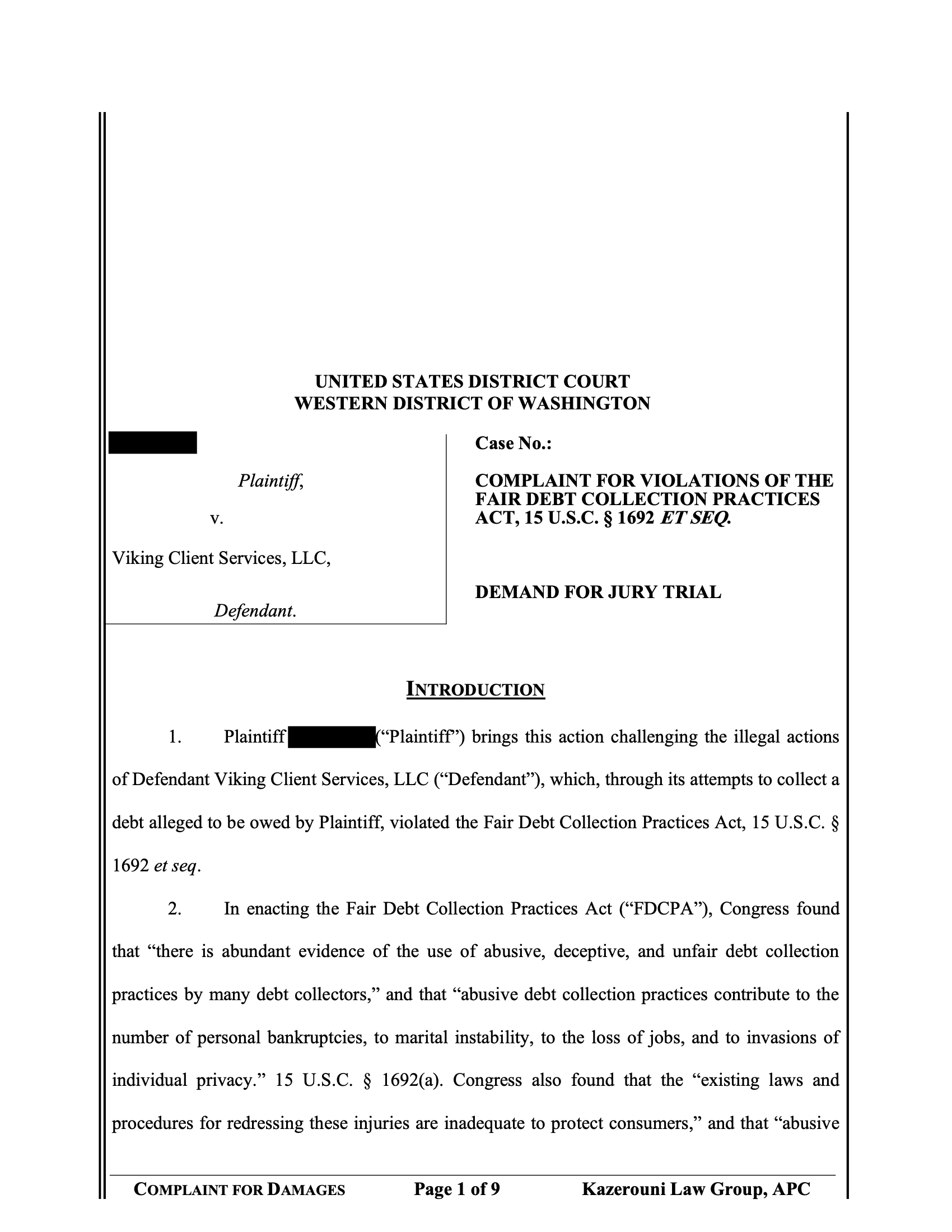

Since the complaint is a public court filing anyway, I’m comfortable sharing this draft here. If you’re curious which debt collector/law firm it is, just look at this image:

TL;DR

- When returning a rental car, say as little as possible.

- When a debt collector calls, immediately send a certified letter requesting debt verification and demanding they cease phone calls.

- If they keep calling → get a free consultation with a fee-shifting FDCPA attorney and enforce your rights. (Statutory damages are usually up to $1,000 per case.)

- Once you decide to sue, the attorney can file the case in federal district court.

- After filing, I reached a settlement with the debt collector that I’m satisfied with. The specific terms of the settlement are confidential.

First, I recommend reading this (Chinese) article: 经验分享 - 如何正确的与讨债公司作斗争? - 美国信用卡指南. I’ll quote some of its general advice on dealing with debt collectors here:

In general, debt collection agencies either collect on behalf of a creditor and take a cut, or they buy charged-off debt at a steep discount (for example, buying $10,000 of debt for $200), then try every possible way—pressure, intimidation, or threats—to make you pay. As long as 2–3 out of 100 people pay, they’re profitable. Also, for people who don’t pay, they usually have the power to report to credit bureaus and ruin your credit. Because of this, the FTC created a specific law to regulate their behavior (otherwise, anyone could hire a collector to go after anyone and tank their credit report—total chaos) — the Fair Debt Collection Practices Act (FDCPA).

The key leverage I had against the debt collector was that they violated the FDCPA: after receiving my written “cease calling” notice, they still called me. Yes, this entire plot twist exists because some agent called me when they weren’t supposed to.

Background

- This all started with a Hertz rental. I didn’t take photos during pick-up. About 10 minutes after driving off I noticed a tiny chip (about a quarter inch across) in the front windshield, which very likely was pre-existing damage. I assumed my credit card insurance would cover it, so I didn’t think more about it. When I returned the car, I told them that I had noticed a windshield issue right after pick-up. (In hindsight this was the biggest lesson: small pre-existing chips/scratches can easily be ignored in the normal process; by proactively “confessing” I actually gave them a chance to charge me.)

- At the counter, on top of the original $200 rental charge, the staff at that Hertz branch simply tacked on a “Return on Damage” fee of $400 (the agent had literally Googled the price of a windshield for that car model on the spot). They did not provide any formal damage or repair documentation, only saying they would review the surveillance footage from pick-up and remove the charge if it was pre-existing damage. As a result, they charged $600 to my card. After that, I was never able to get anyone at that Hertz branch on the phone again.

- I filed an insurance claim with AmEx, but it got stuck because I couldn’t obtain proper supporting documents. I repeatedly asked Hertz for damage/repair documentation but got nothing. So I used ChatGPT to draft a dispute letter and filed a partial dispute on the $400 portion out of the $600. I won that dispute: the “Return on Damage” charge was reversed, and I ended up just paying $200.

- Later Hertz sent updated damage documentation, this time for over $900, with an itemized breakdown. I resubmitted the claim to AmEx, and AmEx reimbursed the entire $900. Hertz followed up as well; I gave them my AmEx claim number, and after they checked it in their system they called me and said, “Congratulations, your insurance company has paid in full.”

The story didn’t end there: enter the debt collector

- About half a year later, a third-party debt collection agency, claiming to represent Hertz, called me and demanded that I pay the $400 “Return on Damage” that the counter had added at vehicle return—the exact amount I had successfully disputed.

- On the call, I asked to use Apple Intelligence to record the conversation, and they agreed. The collector insisted that this charge was “rental fee,” not a repair fee. I asked them on the phone to provide debt verification, but all they sent me was the original receipt from the Hertz location showing the extra $400.

- I was furious. Under the FDCPA, I worked with ChatGPT to draft a written debt verification request plus a cease-call letter and sent it by certified mail. The postage was about $10 (I used Certified Mail Labels.com), which I had to pay, but in exchange I got peace and a solid evidentiary record—totally worth it. I used the template from that article, asking them to provide an itemized cost for the $400 “Return on Damage” issued by a third party.

- Around this time, I also double-checked the insurance situation: AmEx told me they had already mailed a check to Hertz (I couldn’t confirm whether it had been cashed), and Hertz customer service still wouldn’t pick up.

The big twist: they still harass me

While I was waiting for them to mail me proper debt verification that I knew they probably couldn’t produce, the twist came:

- About a month later, the debt collector ignored my certified letter and called me again. As soon as I picked up, I asked to record the call; they agreed. On that call, they claimed they had already mailed the verification materials (I never received anything), and also claimed the charge was for “Return on Damage.” They even directly asked, “Can you give me a credit card number now?”

- This step is the key FDCPA trigger: I had already sent a written cease-call notice, and they still called to collect.

- That call completely infuriated me. The whole reason I asked them to stop calling was that every call came with an extremely aggressive tone, which seriously affected my mood and, indirectly, my life and work.

- I immediately filed complaints with the CFPB and BBB, asking them to stop the harassment and asserting my right to statutory damages of $1,000 under the FDCPA. The collector’s only response was that they would “close the account, not report it to the credit bureaus, and stop calling.” They neither compensated me nor admitted wrongdoing or apologized, so I had no intention of letting it go.

Going to court!

I fed all of the information into what was then the best model, ChatGPT o3-mini-high, and also used its Deep Research feature to have it review prior cases and see whether I had a good claim. GPT’s conclusion was that I was very likely to win. It even found previous cases where other people had sued the same debt collector over harassing calls and gave me actual links. GPT further suggested that I find a fee-shifting FDCPA attorney instead of going through small claims court. I then had ChatGPT help me find a law firm that had already won multiple similar FDCPA cases.

- I filled out an intake form on the firm’s website, and they scheduled a free evaluation with an attorney. The lawyer believed that in addition to FDCPA violations, there might also be issues under the TCPA. They told me that I could get up to $1,000, and if there were TCPA violations, potentially $500 per call.

- This firm, like most FDCPA firms, did not require me to pay anything upfront. If we won, the debt collector would pay the attorney’s fees and I would still receive compensation; if we lost, the firm would eat the costs itself. The only scenario where I might have to pay would be if I chose to drop the case on my own. After weighing things, I decided to sue.

- I provided the lawyer with everything: my certified letter, proof of delivery, call logs, screenshots, call recordings, AmEx reimbursement documents, CFPB/BBB complaints, and a full narrative of what had happened. Because of attorney–client privilege, I gave them all the information I could.

- After reviewing all of the materials, the attorney drafted a very long complaint. In it, we asked the court for (among other things):

- Statutory damages of up to $1,000 under 15 U.S.C. § 1692k(a)(2)(A).

- An order barring the debt collector from contacting me by phone going forward.

- Actual damages under 15 U.S.C. § 1692k(a)(1).

- Punitive damages.

- Costs of the litigation and reasonable attorney’s fees under 15 U.S.C. § 1692k(a)(3).

- Any other relief the court considered fair and appropriate.

What happened next: settlement

After the case was filed in federal district court, the debt collector and my law firm negotiated a settlement. I was satisfied with the outcome and accepted it. Because of the confidentiality clause, I can’t disclose the specific terms.

Takeaways

- Don’t overshare at vehicle return: any subjective description can easily get you charged on the spot, and clawing that money back later is painful. Any damage should be handled by the damage assessment team.

- For suspicious bills, demand written documentation first: a simple receipt screenshot does not equal proper verification.

- For debt collection calls, step one is a certified letter:

- Send a written debt verification request;

- Clearly demand that they stop calling and only contact you in writing (mail/email);

- Use certified mail.

- Save all evidence: statements, texts, call times, caller numbers, mailing receipts, recordings.

- Use multiple channels at the same time: a credit card chargeback/dispute can help you control your financial loss; CFPB/BBB complaints can push them to investigate, close your account, and provide written assurance that they’ll stop calling.

- If you want to pursue compensation, get a lawyer: many of these cases are contingency-based or fee-shifting so you pay nothing upfront (but be mindful of tax implications).

FAQ

Will the rental car company put me on a Do Not Rent (DNR) list?

I sued the debt collection agency, not Hertz itself. My Hertz account has remained active, and I’ve been able to rent from Hertz as usual since the settlement.

Is this small claims court? Do I have to appear in person?

These federal FDCPA cases are usually not handled in small claims court. If you hire an attorney, you typically don’t need to do anything yourself. My case was filed in U.S. District Court; all I did was provide documents and sign a few forms. I’m very happy with my law firm—having a lawyer is much easier than going through small claims, and they’ll also help you fight for higher compensation.

How much can you get?

I can’t disclose my settlement terms, so I can’t tell you how much I received. It really depends on the case, and many cases end in settlement. For settlements, the amount usually takes attorney’s fees into account. My lawyer’s fee was 45% of the settlement, and I was responsible for about $500 in court filing fees (in other words, I got roughly X * 55% - $500). Note that if you settle, the entire settlement amount is generally taxable income, and attorney’s fees and court filing fees may not be fully deductible (Commissioner v. Banks, 543 U.S. 426 (2005)). So if you’re in a high tax bracket that year, there’s a real chance the IRS will claw back a good chunk. (Not tax advice.)

Attachment: The certified mail I sent